Vt payroll calculator

Below are your Vermont salary paycheck results. The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending on your income.

Vermont Property Tax Calculator Smartasset

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is.

. Vermont Hourly Paycheck Calculator Results. Back to Payroll Calculator Menu 2013 Vermont Paycheck Calculator - Vermont Payroll Calculators - Use as often as you need its free. Free Unbiased Reviews Top Picks.

Updated June 2022 These free. Get Your Quote Today with SurePayroll. Ad Compare This Years Top 5 Free Payroll Software.

Career Opportunities with The Vermont Department of Human Resources. The results are broken up into three sections. Paycheck Results is your gross pay and specific.

Calculate your Vermont net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Vermont. Discover ADP Payroll Benefits Insurance Time Talent HR More. Payroll pay salary pay check.

As a State of. Additionally Payroll validates employee pay for compliance with Federal and State regulations and Collective Bargaining Agreements. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Vermont.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Vermont. Welcome to the State of Vermonts VTHR Human Resource information system. Free Unbiased Reviews Top Picks.

Use ADPs Vermont Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The 2022 rates range from 08 to 65 on the first.

Payroll department responsibilities include but are. Calculate your Vermont net pay or take home pay by entering your pay information W4 and Vermont state W4 information. Below are your Vermont salary paycheck results.

Payroll So Easy You Can Set It Up Run It Yourself. Calculating your Vermont state income tax is similar to the steps we listed on our Federal paycheck calculator. All Services Backed by Tax Guarantee.

This free easy to use payroll calculator will calculate your take home pay. Ad Get Started Today with 2 Months Free. The Vermont Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Vermont State.

Well do the math for youall you need to do is enter. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Get On-Demand Access to HR Professionals Customizable Solutions.

Based Specialists Who Know You Your Business by Name. Supports hourly salary income and multiple pay frequencies. Get Started With ADP Payroll.

Ad Compare This Years Top 5 Free Payroll Software. A financial advisor in Vermont can help you understand how taxes fit into your overall financial goals. Additional services and employee support includes.

Financial advisors can also help with investing and financial plans including retirement. The Payroll department is responsible for processing salary wage fellowship and special payments for all Virginia Tech employees. Just enter the wages tax withholdings and other information required.

Ad Process Payroll Faster Easier With ADP Payroll. Vermont State Unemployment Insurance. Once the employer has the information youve entered on forms W-4 and W-4VT the employer is able to calculate your withholding tax.

As an employer in Vermont you have to pay unemployment insurance to the state. VTHR is the secure online system for managing employee data and processing payroll. Get Started With ADP Payroll.

The results are broken up into three sections. Vermont Hourly Paycheck Calculator. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Simply enter their federal and state W-4 information as. Ad Process Payroll Faster Easier With ADP Payroll. To help employers calculate.

Quadratic Keywords Algebra Poster Quadratics Algebra Education Math

Technology May Turn You Into A Bigger Tipper Technology And Society Technology Graphing Calculator

Vermont Payroll Tools Tax Rates And Resources Paycheckcity

Vxus Vs Vt Which Etf Is Right For You

Vermont Postcards X 6 2nd Card Ships Free

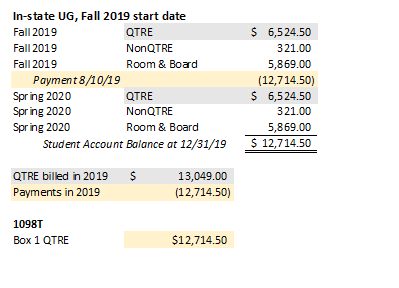

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

Payroll Controller Virginia Tech

Payroll Controller Virginia Tech

Vermont Paycheck Calculator Smartasset

Compare Car Insurance Quotes Fast Free Simple The Zebra Insurance Quotes Compare Car Insurance Website Inspiration

Vermont Paycheck Calculator Smartasset

Vermont Sales Tax Small Business Guide Truic

50 50 Profile Virginia Tech Virginia Tech College Rankings Peace Studies

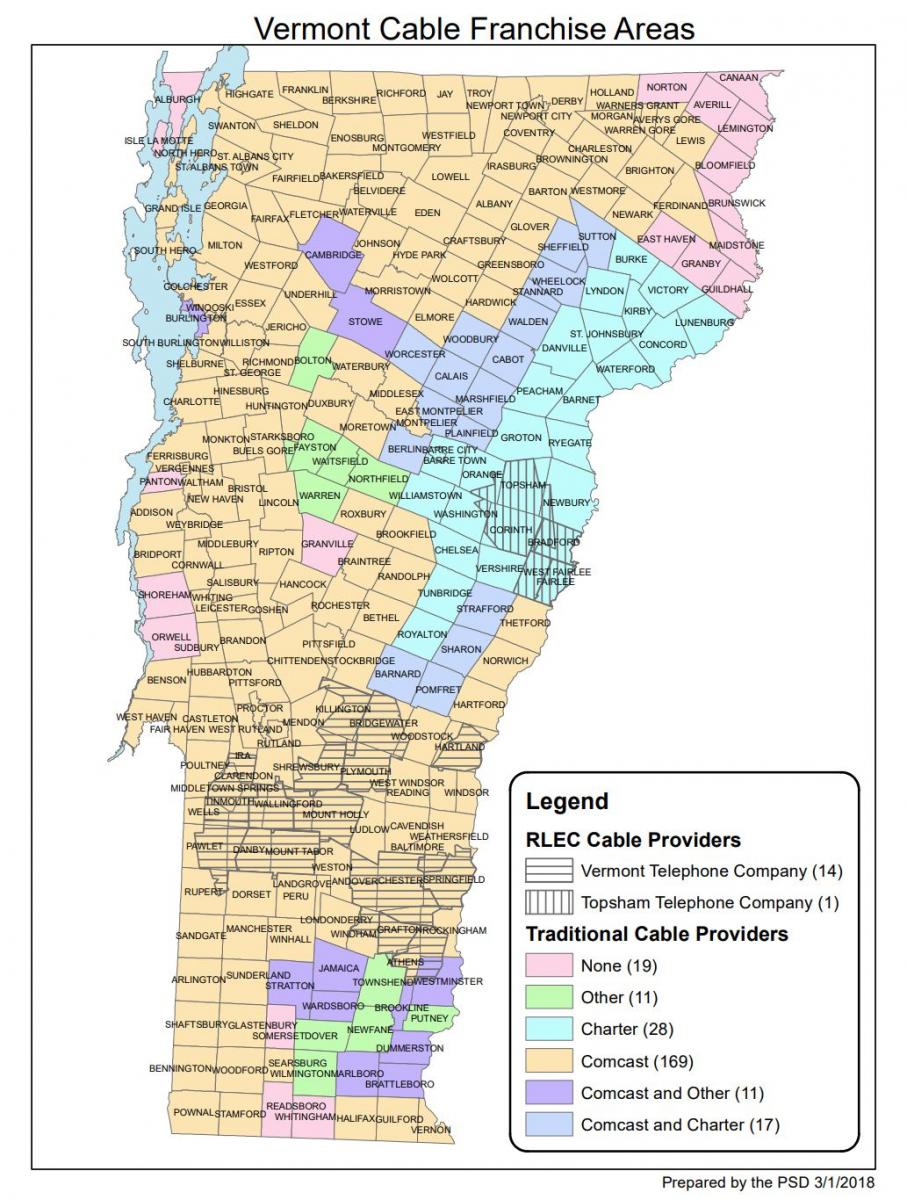

Cable Line Extensions Department Of Public Service

Vectoraic 3 Graphing Calculator Graphing Calculator

Monthly Take Home Pay From A 100k Annual Salary Vivid Maps Map Personal Financial Planning Salary

Free Vermont Payroll Calculator 2022 Vt Tax Rates Onpay